76+ pages the tax liability of a corporation with ordinary income 1.7mb. 0 to 50000 15 50000 to 75000 25 75000 to 100000 34 100000 to 335000 39 335000 to 10000000 34 10000000 to 15000000 35 A 362250 B 340000 C 374000 D 390000. The tax liability of a corporation with ordinary income of 105000 is _____. 6 The tax liability of a corporation with ordinary income of 1100000 is Range of taxable income Marginal rate 0 to _50000 50000 to 75000 75000 to 100000 100000 to 335000 335000 to 10000000 10000000 to 15000000 15 25 34 39 34 35. Check also: with and learn more manual guide in the tax liability of a corporation with ordinary income Range of taxable income - Marginal rate 0 to 50000 - 15 50000 to 75000 - 25 75000 to 100000 - 34 100000 to 335000 - 39 335000 to 10000000 - 34 10000000 to 15000000 - 35 15000000 to 18333333 - 38 Over 18333333 - 35 A 42000 B 35700 C 23950 D 24450.

Correct answer - The tax liability of a corporation with ordinary income of 105000 is. Range of taxable income marginal rate 0 to 50000 15 50000 to 75000 25 75000 to 100000 34 100000 to 335000 39 335000 to 10000000 34 10000000 to 15000000 35.

Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges

| Title: Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges |

| Format: ePub Book |

| Number of Pages: 162 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: April 2018 |

| File Size: 1.35mb |

| Read Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges |

|

The tax liability of a corporation with ordinary income of 1100000 is A 362250 from ACCOUNTING 213 at Pontifical Catholic.

Asked Dec 12 2018 in Business by Aaronb411. A 46 percent B 23 percent C 34 percent D 15 percent. Has a tax liability of 170000 on pretax income of 500000. The tax liability of a corporation with ordinary income of 105000 is. The tax liability of a corporation with ordinary income of 105000 is _____. 2 question The tax liability of a corporation with ordinary income of 105000 is _.

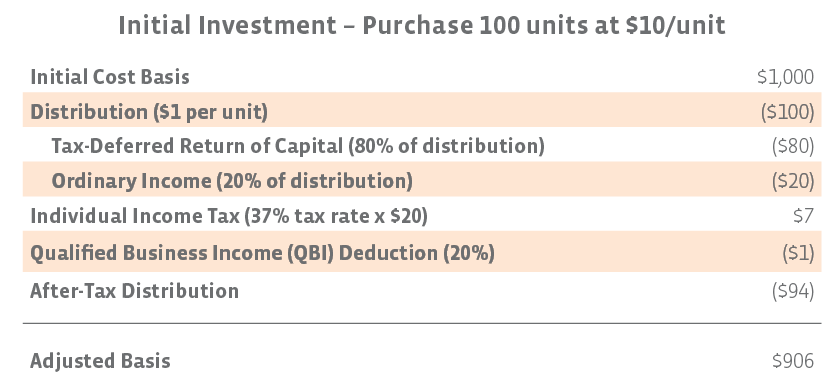

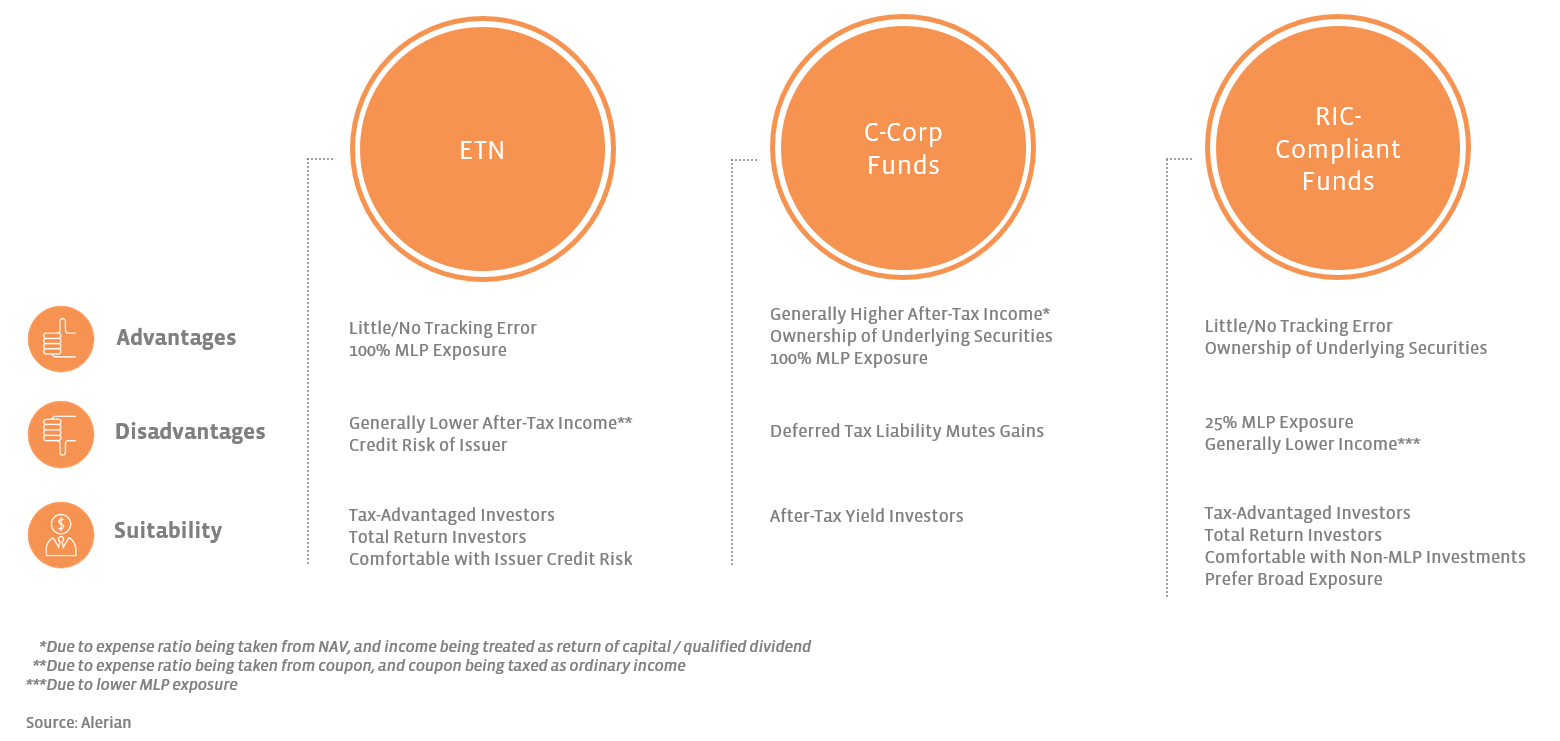

Mlp Taxation The Benefits And What You Need To Know

| Title: Mlp Taxation The Benefits And What You Need To Know |

| Format: PDF |

| Number of Pages: 322 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: March 2019 |

| File Size: 800kb |

| Read Mlp Taxation The Benefits And What You Need To Know |

|

Mlp Taxation The Benefits And What You Need To Know

| Title: Mlp Taxation The Benefits And What You Need To Know |

| Format: eBook |

| Number of Pages: 268 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: January 2018 |

| File Size: 1.2mb |

| Read Mlp Taxation The Benefits And What You Need To Know |

|

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

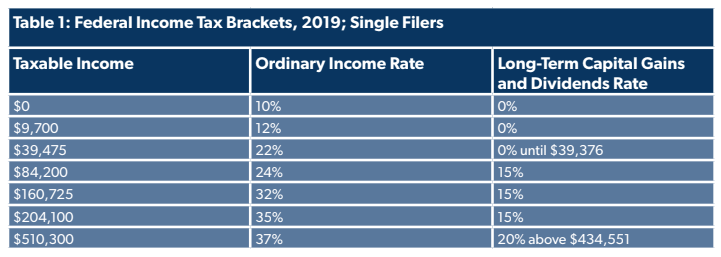

How Are Capital Gains And Dividends Taxed Differently

| Title: How Are Capital Gains And Dividends Taxed Differently |

| Format: eBook |

| Number of Pages: 304 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: June 2020 |

| File Size: 3mb |

| Read How Are Capital Gains And Dividends Taxed Differently |

|

Guide To Taxes On Dividends Intelligent Ine Simply Safe Dividends

| Title: Guide To Taxes On Dividends Intelligent Ine Simply Safe Dividends |

| Format: eBook |

| Number of Pages: 142 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: May 2018 |

| File Size: 2.3mb |

| Read Guide To Taxes On Dividends Intelligent Ine Simply Safe Dividends |

|

Bob S Personal Wealth Including Investments In Lan Chegg Investing Capital Gains Tax Writing Inspiration

| Title: Bob S Personal Wealth Including Investments In Lan Chegg Investing Capital Gains Tax Writing Inspiration |

| Format: eBook |

| Number of Pages: 342 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: January 2020 |

| File Size: 6mb |

| Read Bob S Personal Wealth Including Investments In Lan Chegg Investing Capital Gains Tax Writing Inspiration |

|

What Taxes Are Involved When Selling My Online Business

| Title: What Taxes Are Involved When Selling My Online Business |

| Format: ePub Book |

| Number of Pages: 291 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: February 2019 |

| File Size: 2.8mb |

| Read What Taxes Are Involved When Selling My Online Business |

|

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

| Title: Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union |

| Format: PDF |

| Number of Pages: 192 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: November 2018 |

| File Size: 3mb |

| Read Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union |

|

Sweeg Reform Would Tax Capital Gains Like Ordinary Ine Itep

| Title: Sweeg Reform Would Tax Capital Gains Like Ordinary Ine Itep |

| Format: ePub Book |

| Number of Pages: 340 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: December 2019 |

| File Size: 1.8mb |

| Read Sweeg Reform Would Tax Capital Gains Like Ordinary Ine Itep |

|

Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges

| Title: Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges |

| Format: eBook |

| Number of Pages: 179 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: May 2019 |

| File Size: 2.8mb |

| Read Reporting Publicly Traded Partnership Sec 751 Ordinary Ine And Other Challenges |

|

Tax Implications Of Selling Mercial Real Estate 2021 Guide Property Cashin

| Title: Tax Implications Of Selling Mercial Real Estate 2021 Guide Property Cashin |

| Format: eBook |

| Number of Pages: 222 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: July 2017 |

| File Size: 2.2mb |

| Read Tax Implications Of Selling Mercial Real Estate 2021 Guide Property Cashin |

|

Taxable Items And Nontaxable Items Chart Ine Accounting And Finance Fafsa

| Title: Taxable Items And Nontaxable Items Chart Ine Accounting And Finance Fafsa |

| Format: eBook |

| Number of Pages: 240 pages The Tax Liability Of A Corporation With Ordinary Income |

| Publication Date: January 2019 |

| File Size: 1.35mb |

| Read Taxable Items And Nontaxable Items Chart Ine Accounting And Finance Fafsa |

|

Has a tax liability of 170000 on pretax income of 500000. The tax liability of a corporation with ordinary income of 105000 is _____. The tax liability of a corporation with ordinary income of 105000 is.

Here is all you have to to learn about the tax liability of a corporation with ordinary income The tax liability of a corporation with ordinary income of 1700000 is _____. The average tax rate of a corporation with ordinary income of 105000 and a tax liability of 24200 is _____. A 46 percent B 23 percent C 34 percent D 15 percent. Sweeg reform would tax capital gains like ordinary ine itep how are capital gains and dividends taxed differently bob s personal wealth including investments in lan chegg investing capital gains tax writing inspiration mlp taxation the benefits and what you need to know guide to taxes on dividends intelligent ine simply safe dividends structural questions abound with new mark to market tax proposal foundation national taxpayers union 2 question The tax liability of a corporation with ordinary income of 105000 is _.

0 Comments